JustMarkets is a global forex and CFD broker established in 2012, offering traders access to multiple financial markets through the popular MetaTrader platforms. With regulation from several financial authorities, competitive spreads starting from 0.0 pips, and a low minimum deposit of just $10, JustMarkets has positioned itself as an accessible option for both beginner and experienced traders. This comprehensive review examines everything from account types and trading platforms to fees, available assets, and customer support quality to help you determine if JustMarkets is the right broker for your trading needs.

Start Trading with JustMarkets Today

Open an account with just $10 minimum deposit and access 260+ trading instruments with tight spreads from 0.0 pips.

JustMarkets Broker Overview

Founded in 2012, JustMarkets (previously known as JustForex) has established itself as a global online broker serving clients from over 190 countries. The company operates through several regulated entities to ensure compliance with local financial regulations across different regions.

Regulation and Security

JustMarkets operates through multiple regulated entities, providing an additional layer of security for traders. The broker’s regulatory oversight includes:

| Entity | Regulator | License Number | Region Served |

| JustMarkets Ltd | Cyprus Securities and Exchange Commission (CySEC) | 401/21 | European Union |

| Just Global Markets Ltd | Financial Services Authority (FSA) Seychelles | SD088 | Global |

| Just Global Markets (PTY) Ltd | Financial Sector Conduct Authority (FSCA) South Africa | FSP 51114 | Africa |

| Just Global Markets (MU) Limited | Financial Services Commission (FSC) Mauritius | GB22200881 | Asia |

JustMarkets implements several security measures to protect client funds and personal information, including:

- Segregated client funds in separate bank accounts

- Negative balance protection for all clients

- Bank-grade SSL encryption for data security

- Compliance with PCI DSS security standards

- Two-factor authentication (2FA) for account security

Note: JustMarkets does not accept clients from certain jurisdictions, including the United States, United Kingdom, Japan, Australia, and European Union countries. Always check the latest restrictions before attempting to open an account.

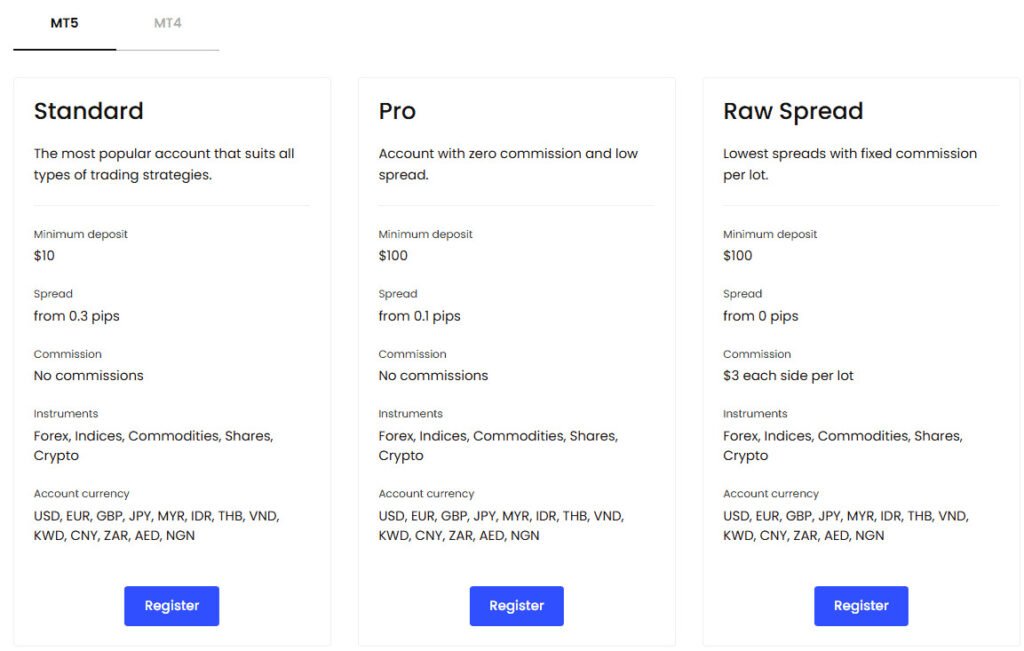

JustMarkets Account Types

JustMarkets offers several account types designed to accommodate different trading styles and experience levels. Each account type provides unique features and trading conditions to suit various trader needs.

| Feature | Standard | Standard Cent | Pro | Raw Spread |

| Minimum Deposit | $10 | $10 | $100 | $100 |

| Spreads From | 0.3 pips | 0.3 pips | 0.1 pips | 0.0 pips |

| Commission | No commission | No commission | No commission | $3 per side/lot |

| Maximum Leverage | Up to 1:3000 | Up to 1:3000 | Up to 1:3000 | Up to 1:3000 |

| Platforms | MT4/MT5 | MT4 only | MT4/MT5 | MT4/MT5 |

| Base Currencies | 13 currencies | USC (US Cents) | 13 currencies | 13 currencies |

| Margin Call/Stop Out | 40%/20% | 40%/20% | 40%/20% | 40%/20% |

| Ideal For | Beginners | Micro-trading | Experienced traders | Scalpers/HFT |

Standard Account

The Standard account is JustMarkets’ entry-level offering, ideal for beginners with its low $10 minimum deposit requirement. This account type features commission-free trading with spreads starting from 0.3 pips, making it accessible for those just starting their trading journey. The Standard account supports both MT4 and MT5 platforms and offers access to all available trading instruments.

Standard Cent Account

The Standard Cent account is specifically designed for micro-lot trading and risk management. With this account, positions are opened in cent lots (0.01 cent lot = 1,000 units of the base currency), allowing traders to practice with minimal risk. This account type is only available on the MT4 platform and has limited instrument availability compared to other account types.

Pro Account

The Pro account is tailored for more experienced traders who require tighter spreads. With a minimum deposit of $100, this account offers spreads from 0.1 pips with no commission. The Pro account is suitable for various trading strategies and provides access to all available instruments on both MT4 and MT5 platforms.

Raw Spread Account

The Raw Spread account (formerly ECN account) offers the tightest spreads starting from 0.0 pips with a commission of $3 per side per lot. This account type is ideal for scalpers and high-frequency traders who prioritize execution speed and minimal trading costs. The minimum deposit requirement is $100, and it supports both MT4 and MT5 platforms.

Islamic (Swap-Free) Account

JustMarkets offers swap-free accounts for traders who follow Islamic principles. These accounts comply with Sharia law by eliminating overnight interest charges (swaps). The swap-free option is available for all account types upon request and maintains the same trading conditions as standard accounts.

Demo Account

For those who want to practice trading without financial risk, JustMarkets provides free demo accounts with virtual funds of up to $5 million. These accounts simulate real market conditions and allow traders to test strategies, explore platform features, and gain confidence before transitioning to live trading.

Find the Right Account for Your Trading Style

Open a JustMarkets account today with as little as $10 and access competitive trading conditions across multiple financial markets.

JustMarkets Trading Platforms

JustMarkets offers industry-standard trading platforms that provide traders with powerful tools for market analysis and trade execution. The broker supports both MetaTrader 4 and MetaTrader 5, along with mobile applications for trading on the go.

MetaTrader 4 (MT4)

MetaTrader 4 remains one of the most popular trading platforms globally, known for its user-friendly interface and powerful features. JustMarkets’ MT4 offering includes:

- 30+ built-in technical indicators for market analysis

- 9 timeframes for multi-timeframe analysis

- Support for Expert Advisors (EAs) for automated trading

- One-click trading for fast execution

- Multiple chart types (line, bar, candlestick)

- Available for Windows, Mac, Web, iOS, and Android

MetaTrader 5 (MT5)

MetaTrader 5 is the advanced successor to MT4, offering enhanced features and capabilities for more sophisticated trading. JustMarkets’ MT5 platform includes:

- 80+ built-in technical indicators for comprehensive analysis

- 21 timeframes for detailed market examination

- Advanced MQL5 programming language for custom indicators and EAs

- Economic calendar integration for fundamental analysis

- Market depth (DOM) information for better execution

- Available for Windows, Mac, Web, iOS, and Android

JustMarkets Mobile App

In addition to the MetaTrader mobile applications, JustMarkets offers its proprietary mobile app that provides a seamless trading experience on smartphones and tablets. The app features:

- Advanced charting with 1,000+ technical indicators

- Real-time market quotes and notifications

- Complete order management capabilities

- Account management including deposits and withdrawals

- Economic calendar and market news

- 24/7 multilingual live chat support

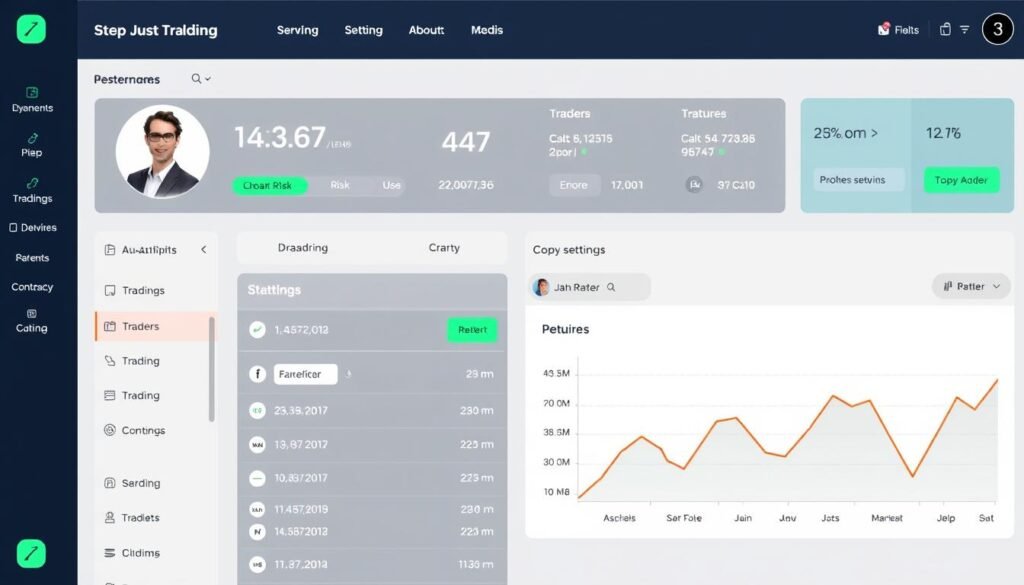

Copy Trading

JustMarkets provides a copy trading service that allows traders to automatically replicate the strategies of successful traders. This feature is particularly useful for beginners who want to learn from experienced traders or those who prefer a more passive approach to trading.

The copy trading service includes:

- No additional fees for copy trading (only standard trading costs apply)

- Easy-to-use interface for selecting signal providers

- Customizable risk management settings

- Real-time monitoring of copied trades

- Option to become a signal provider and earn additional income

Experience Advanced Trading Platforms

Access MetaTrader 4, MetaTrader 5, and the JustMarkets mobile app with a single account. Start with just $10.

JustMarkets Fees and Spreads

JustMarkets offers competitive trading costs across its various account types. The fee structure is transparent, with most costs embedded in the spread for Standard and Pro accounts, while Raw Spread accounts feature tighter spreads with an additional commission.

Spreads

Spreads vary depending on the account type and market conditions. Below are the typical spreads for major forex pairs:

| Instrument | Standard Account | Pro Account | Raw Spread Account |

| EUR/USD | From 0.9 pips | From 0.7 pips | From 0.0 pips + $6 commission |

| GBP/USD | From 1.2 pips | From 0.9 pips | From 0.1 pips + $6 commission |

| USD/JPY | From 1.0 pips | From 0.8 pips | From 0.1 pips + $6 commission |

| XAU/USD (Gold) | From 18 pips | From 15 pips | From 10 pips + $6 commission |

| US30 (Dow Jones) | From 6.9 points | From 4.5 points | From 3.0 points + $6 commission |

Commissions

JustMarkets’ commission structure is straightforward:

- Standard and Pro Accounts: No commission (costs included in the spread)

- Raw Spread Account: $3 per side per lot ($6 round-turn per standard lot)

Swap Rates (Overnight Financing)

When positions are held overnight, swap rates (financing charges) apply. These rates vary by instrument and depend on the interest rate differential between the currencies involved. For example:

| Instrument | Swap Long (Buy) | Swap Short (Sell) |

| EUR/USD | -$6.94 per lot | $0 per lot |

| GBP/JPY | $0 per lot | -$37.02 per lot |

Note: Swap rates are tripled on Wednesday to account for the weekend. Islamic (swap-free) accounts do not incur swap charges.

Non-Trading Fees

JustMarkets keeps non-trading fees to a minimum:

- Deposit Fees: No fees from JustMarkets (third-party payment providers may charge fees)

- Withdrawal Fees: No fees from JustMarkets (third-party payment providers may charge fees)

- Inactivity Fee: $5 per month after 150 days of inactivity

- Account Maintenance Fee: None

Leverage and Margin Requirements

JustMarkets offers high leverage options, though the maximum available leverage depends on the regulatory entity and account balance:

- CySEC-regulated accounts: Up to 1:30 for retail clients (higher for professional clients)

- FSA, FSCA, and FSC-regulated accounts: Up to 1:3000 for accounts with balance below $1,000

- Leverage is automatically reduced as account balance increases for risk management

Margin requirements vary by instrument and leverage level. The margin call level is set at 40%, and the stop-out level is at 20% for all account types.

Trade with Competitive Costs

Access tight spreads from 0.0 pips and high leverage up to 1:3000 with JustMarkets.

JustMarkets Assets and Instruments

JustMarkets offers a diverse range of trading instruments across multiple asset classes, allowing traders to diversify their portfolios and capitalize on various market opportunities.

Forex

JustMarkets provides access to over 60 currency pairs, including:

- Major pairs: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD, USD/CHF, NZD/USD

- Minor pairs: EUR/GBP, EUR/AUD, GBP/JPY, EUR/CAD, AUD/NZD, and more

- Exotic pairs: USD/TRY, EUR/PLN, USD/ZAR, USD/MXN, and others

Cryptocurrencies

Traders can access 17 cryptocurrency CFDs, including:

- Bitcoin (BTC/USD)

- Ethereum (ETH/USD)

- Ripple (XRP/USD)

- Litecoin (LTC/USD)

- Bitcoin Cash (BCH/USD)

- Cardano (ADA/USD)

- Dogecoin (DOGE/USD)

- Solana (SOL/USD)

- And several other altcoins

Stocks

JustMarkets offers over 160 stock CFDs from major global markets:

- US stocks: Apple, Amazon, Tesla, Microsoft, Google, Netflix, and more

- European stocks: Mercedes, BMW, Deutsche Bank, and others

- Asian stocks: Selected companies from major Asian markets

Indices

Traders can access 13 global stock indices, including:

- US indices: S&P 500, Dow Jones 30, Nasdaq 100

- European indices: Germany 40 (DAX), UK 100 (FTSE), France 40 (CAC)

- Asian indices: Japan 225 (Nikkei), Hong Kong 50, and others

Commodities

JustMarkets offers 10 commodity CFDs across two categories:

- Metals: Gold (XAU/USD), Silver (XAG/USD), Platinum, Palladium

- Energies: Crude Oil (WTI), Brent Oil, Natural Gas

Trading Hours

Trading hours vary by instrument:

- Forex: 24/5 from Monday 00:00 to Friday 23:59 (server time)

- Cryptocurrencies: 24/7 with brief maintenance periods

- Stocks and Indices: According to the respective exchange trading hours

- Commodities: Various sessions depending on the specific instrument

Access 260+ Trading Instruments

Trade forex, stocks, cryptocurrencies, indices, and commodities from a single platform with JustMarkets.

JustMarkets Customer Support

JustMarkets provides 24/7 customer support in multiple languages to assist traders with account-related questions, technical issues, and general inquiries.

Support Channels

Traders can contact JustMarkets through various channels:

- Live Chat: Available 24/7 directly from the website and mobile app

- Email: support@justmarkets.com for general inquiries, partners@justmarkets.com for partnership questions

- Phone: +248 4632027 and +230 52970330 (international rates may apply)

- Callback Request: Option to request a callback from the support team

- Messengers: Support via Telegram, WhatsApp, Viber, and other popular messaging apps

Languages Supported

JustMarkets offers multilingual support in:

- English

- Indonesian

- Malaysian

- Spanish

- Portuguese

- Vietnamese

Response Times

Based on our testing and user reviews, JustMarkets’ support team is generally responsive:

- Live Chat: Typically connects to an agent within 1-2 minutes

- Email: Responses usually received within 24 hours

- Phone: Average wait time of 2-5 minutes during peak hours

JustMarkets Educational Resources

JustMarkets provides a range of educational materials to help traders develop their skills and knowledge. These resources cater to traders of all experience levels, from beginners to advanced.

Learning Center

JustMarkets’ learning center includes various educational materials:

- Trading Articles: Over 300 articles covering trading strategies, technical analysis, fundamental analysis, and risk management

- Video Tutorials: Step-by-step guides on using the MetaTrader platforms and implementing trading techniques

- Webinars: Regular online sessions covering various trading topics, conducted by experienced traders

- Forex Glossary: Comprehensive dictionary of trading terms and concepts

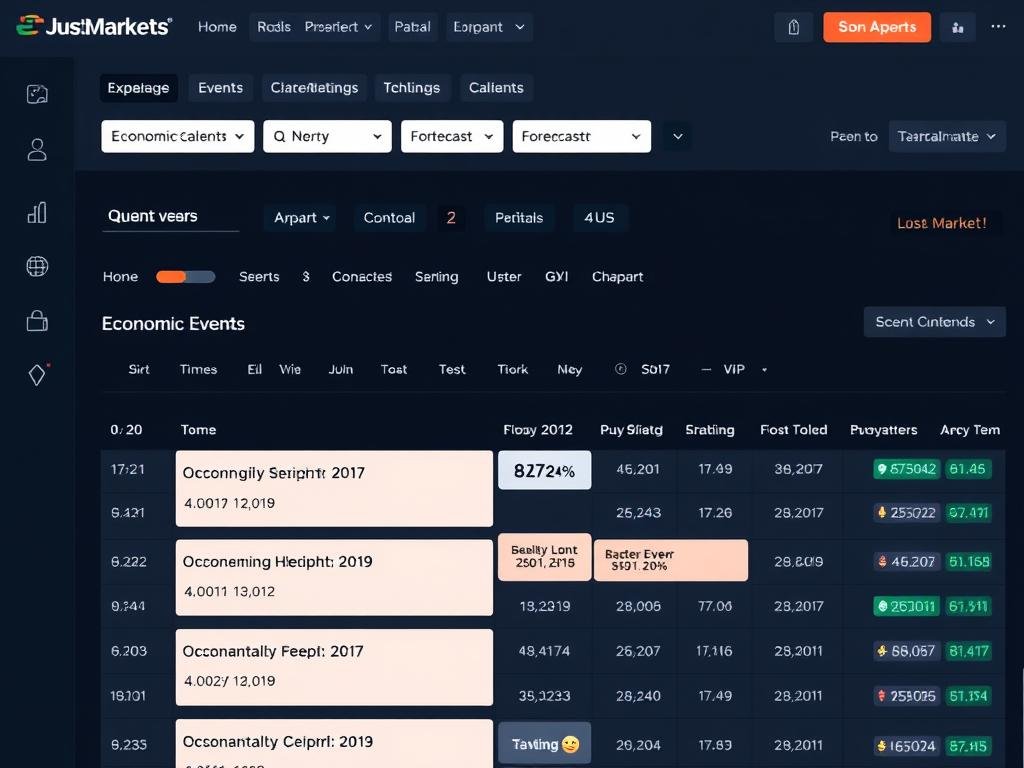

Market Analysis

JustMarkets provides regular market analysis to help traders make informed decisions:

- Daily Market Breakdowns: Analysis of current market conditions and potential trading opportunities

- Technical Forecasts: Price predictions based on technical analysis for various instruments

- Economic Calendar: Upcoming economic events and their potential market impact

Trading Tools

In addition to educational resources, JustMarkets offers several tools to enhance trading performance:

- Economic Calendar: Real-time updates on economic events and their market impact

- Trading Calculators: Tools for calculating pip value, margin, profit/loss, and swap charges

- VPS Hosting: Virtual Private Server options for stable automated trading (additional fees may apply)

Enhance Your Trading Knowledge

Access JustMarkets’ comprehensive educational resources and trading tools to improve your trading skills.

Deposit and Withdrawal Methods

JustMarkets offers a wide range of payment options for deposits and withdrawals, catering to traders from different regions. The broker does not charge fees for deposits or withdrawals, though third-party payment providers may apply their own fees.

Deposit Methods

JustMarkets accepts deposits through various payment methods:

| Payment Method | Processing Time | Minimum Deposit | Fee |

| Credit/Debit Cards (Visa/Mastercard) | Instant | $10 | No fee from JustMarkets |

| Bank Wire Transfer | 1-6 business days | $10 | No fee from JustMarkets |

| E-wallets (Skrill, Neteller, Perfect Money) | Instant | $10 | No fee from JustMarkets |

| Local Payment Methods (FasaPay, SticPay) | Instant | $10 | No fee from JustMarkets |

| Cryptocurrencies (Bitcoin, Ethereum, etc.) | 1-3 hours | $10 | No fee from JustMarkets |

Withdrawal Methods

Withdrawals can be processed through the same methods used for deposits:

| Payment Method | Processing Time | Minimum Withdrawal | Fee |

| Credit/Debit Cards (Visa/Mastercard) | Up to 2 hours | $10 | No fee from JustMarkets |

| Bank Wire Transfer | 1-6 business days | $10 | No fee from JustMarkets |

| E-wallets (Skrill, Neteller, Perfect Money) | Up to 2 hours | $10 | No fee from JustMarkets |

| Local Payment Methods (FasaPay, SticPay) | Up to 2 hours | $10 | No fee from JustMarkets |

| Cryptocurrencies (Bitcoin, Ethereum, etc.) | Up to 3 hours | $10 | No fee from JustMarkets |

Important: JustMarkets requires account verification before processing withdrawals. This includes providing proof of identity and proof of address documents in accordance with anti-money laundering (AML) regulations.

JustMarkets vs Competitors

To provide a comprehensive perspective, we’ve compared JustMarkets with two popular competitors: IC Markets and Pepperstone. This comparison highlights the key differences in trading conditions, platforms, and services.

| Feature | JustMarkets | IC Markets | Pepperstone |

| Regulation | CySEC, FSA, FSCA, FSC | ASIC, CySEC, FSA | FCA, ASIC, CySEC, DFSA, SCB |

| Minimum Deposit | $10 | $200 | $200 |

| Spreads (EUR/USD) | From 0.0 pips + commission | From 0.0 pips + commission | From 0.0 pips + commission |

| Commission (Round Trip) | $6 per lot | $7 per lot | $7 per lot |

| Maximum Leverage | Up to 1:3000 | Up to 1:500 | Up to 1:500 |

| Trading Platforms | MT4, MT5, Mobile App | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Number of Instruments | 260+ | 230+ | 180+ |

| Customer Support | 24/7 | 24/7 | 24/5 |

| Demo Account | Yes | Yes | Yes |

| Islamic Account | Yes | Yes | Yes |

Key Differences

While all three brokers offer competitive trading conditions, there are some notable differences:

- Minimum Deposit: JustMarkets has a significantly lower entry barrier with a $10 minimum deposit compared to $200 for both IC Markets and Pepperstone.

- Leverage: JustMarkets offers higher maximum leverage (up to 1:3000) compared to IC Markets and Pepperstone (up to 1:500).

- Platforms: IC Markets and Pepperstone offer cTrader in addition to MetaTrader platforms, while JustMarkets focuses on MT4/MT5 with its proprietary mobile app.

- Regulation: Pepperstone has more tier-1 regulatory oversight with FCA and ASIC licenses, potentially offering stronger client protections.

- Commissions: JustMarkets has slightly lower commission rates on its Raw Spread account compared to the competitors.

JustMarkets Pros and Cons

Based on our comprehensive review, here’s a summary of JustMarkets’ strengths and weaknesses:

Pros

- Low minimum deposit of just $10, making it accessible for beginners

- Competitive spreads starting from 0.0 pips on Raw Spread accounts

- High maximum leverage up to 1:3000 (on non-EU regulated accounts)

- Multiple regulatory licenses providing enhanced security

- No fees for deposits and withdrawals

- Fast order execution speeds (around 52ms on average)

- Cost-free copy trading service

- Wide range of payment methods including cryptocurrencies

- 24/7 multilingual customer support

- Negative balance protection for all clients

Cons

- Limited platform options compared to some competitors (no cTrader)

- Not available for traders from the US, UK, Australia, and EU countries

- Limited research tools and third-party integrations

- Higher swap rates compared to some competitors

- No ETFs or bonds for portfolio diversification

- Limited educational content for advanced traders

- $5 monthly inactivity fee after 150 days

Frequently Asked Questions

Is JustMarkets regulated?

Yes, JustMarkets operates through multiple regulated entities. These include JustMarkets Ltd regulated by CySEC (Cyprus), Just Global Markets Ltd regulated by FSA (Seychelles), Just Global Markets (PTY) Ltd regulated by FSCA (South Africa), and Just Global Markets (MU) Limited regulated by FSC (Mauritius). This multi-jurisdictional approach ensures compliance with various regulatory frameworks.

What is the minimum deposit for JustMarkets?

The minimum deposit for JustMarkets varies by account type. Standard and Standard Cent accounts require a minimum deposit of , while Pro and Raw Spread accounts require a minimum deposit of 0. This low entry barrier makes JustMarkets accessible for traders with limited capital.

Which trading platforms does JustMarkets offer?

JustMarkets offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, available for desktop (Windows and Mac), web browsers, and mobile devices (iOS and Android). The broker also provides its proprietary mobile app with advanced charting capabilities and account management features.

Does JustMarkets offer negative balance protection?

Yes, JustMarkets provides negative balance protection for all clients regardless of the regulatory entity. This means that traders cannot lose more than their deposited funds, even in cases of extreme market volatility or gaps.

What are the spreads like at JustMarkets?

JustMarkets offers competitive spreads that vary by account type. Standard accounts have spreads from 0.3 pips, Pro accounts from 0.1 pips, and Raw Spread accounts from 0.0 pips with a commission of per side per lot. Actual spreads may widen during volatile market conditions or news releases.

How long do withdrawals take with JustMarkets?

JustMarkets processes withdrawal requests within 1-2 hours for most payment methods. E-wallet withdrawals typically complete within 2 hours, cryptocurrency withdrawals within 3 hours, and bank wire transfers within 1-6 business days. The broker does not charge withdrawal fees, though third-party payment providers may apply their own fees.

Does JustMarkets offer Islamic (swap-free) accounts?

Yes, JustMarkets offers Islamic (swap-free) accounts that comply with Sharia law by eliminating overnight interest charges. This option is available for all account types upon request and maintains the same trading conditions as standard accounts.

What leverage does JustMarkets offer?

JustMarkets offers leverage up to 1:3000 for accounts regulated by FSA, FSCA, and FSC with balances below

Frequently Asked Questions

Is JustMarkets regulated?

Yes, JustMarkets operates through multiple regulated entities. These include JustMarkets Ltd regulated by CySEC (Cyprus), Just Global Markets Ltd regulated by FSA (Seychelles), Just Global Markets (PTY) Ltd regulated by FSCA (South Africa), and Just Global Markets (MU) Limited regulated by FSC (Mauritius). This multi-jurisdictional approach ensures compliance with various regulatory frameworks.

What is the minimum deposit for JustMarkets?

The minimum deposit for JustMarkets varies by account type. Standard and Standard Cent accounts require a minimum deposit of $10, while Pro and Raw Spread accounts require a minimum deposit of $100. This low entry barrier makes JustMarkets accessible for traders with limited capital.

Which trading platforms does JustMarkets offer?

JustMarkets offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, available for desktop (Windows and Mac), web browsers, and mobile devices (iOS and Android). The broker also provides its proprietary mobile app with advanced charting capabilities and account management features.

Does JustMarkets offer negative balance protection?

Yes, JustMarkets provides negative balance protection for all clients regardless of the regulatory entity. This means that traders cannot lose more than their deposited funds, even in cases of extreme market volatility or gaps.

What are the spreads like at JustMarkets?

JustMarkets offers competitive spreads that vary by account type. Standard accounts have spreads from 0.3 pips, Pro accounts from 0.1 pips, and Raw Spread accounts from 0.0 pips with a commission of $3 per side per lot. Actual spreads may widen during volatile market conditions or news releases.

How long do withdrawals take with JustMarkets?

JustMarkets processes withdrawal requests within 1-2 hours for most payment methods. E-wallet withdrawals typically complete within 2 hours, cryptocurrency withdrawals within 3 hours, and bank wire transfers within 1-6 business days. The broker does not charge withdrawal fees, though third-party payment providers may apply their own fees.

Does JustMarkets offer Islamic (swap-free) accounts?

Yes, JustMarkets offers Islamic (swap-free) accounts that comply with Sharia law by eliminating overnight interest charges. This option is available for all account types upon request and maintains the same trading conditions as standard accounts.

What leverage does JustMarkets offer?

JustMarkets offers leverage up to 1:3000 for accounts regulated by FSA, FSCA, and FSC with balances below $1,000. For CySEC-regulated accounts, the maximum leverage is 1:30 for retail clients in compliance with ESMA regulations. Professional clients may access higher leverage. The actual leverage available depends on the instrument traded and account balance.

Conclusion: Is JustMarkets Right for You?

JustMarkets offers a compelling package for traders of all experience levels, with its low minimum deposit, competitive spreads, and diverse instrument selection. The broker’s multiple regulatory licenses provide an additional layer of security, while features like negative balance protection and segregated client funds further enhance trader protection.

For beginners, JustMarkets’ $10 minimum deposit and user-friendly platforms make it an accessible entry point into the trading world. More experienced traders will appreciate the Raw Spread account with tight spreads and fast execution speeds, along with the high leverage options available on non-EU regulated accounts.

However, traders should consider the limitations, including the unavailability for residents of certain countries, the limited platform options compared to some competitors, and the relatively higher swap rates for overnight positions. Those seeking more advanced research tools or a wider range of instruments including ETFs and bonds might want to explore additional options.

Overall, JustMarkets stands out as a solid broker offering good value, particularly for those prioritizing low entry costs, competitive trading fees, and reliable execution. The broker’s continuous improvements and expanding global presence suggest a commitment to enhancing the trading experience for its clients.

Ready to Start Trading with JustMarkets?

Open an account today with just $10 and access 260+ trading instruments with competitive conditions.