JustMarkets Deposit & Withdrawal Methods – Global Payment Guide

For traders across the world, reliable and flexible payment systems are just as important as trading spreads and execution speed. This comprehensive guide will help you understand how deposits and withdrawals work at JustMarkets — from global and regional payment methods to processing times, limits, and best practices for secure fund management in 2025.

Why Funding Methods Matter for Global Traders

The quality of a broker’s deposit and withdrawal systems can define the trader’s entire experience.

Here’s why:

-

Accessibility: A variety of payment methods allows traders from different regions to easily fund their accounts.

-

Speed: Quick deposits and withdrawals help traders seize market opportunities without delays.

-

Transparency: Clear fee structures and rules build trust.

-

Security: Compliance and verification procedures protect both broker and trader.

A broker that invests in efficient payment systems shows commitment to supporting its clients globally — and JustMarkets does exactly that.

Deposit Methods at JustMarkets

Global Deposit Options

JustMarkets provides a wide selection of globally recognized payment methods, allowing traders to fund their accounts easily:

-

Bank Cards (Visa, MasterCard): Instant or within minutes.

-

E-Wallets (Skrill, Neteller, Perfect Money, SticPay, etc.): Typically instant across many regions.

-

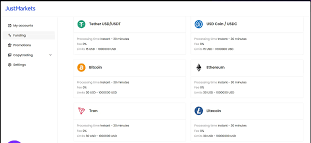

Cryptocurrencies (BTC, ETH, USDT, BUSD, etc.): Deposits are usually processed within one hour.

-

Bank Wire Transfers: Best for large amounts, though they may take 1–6 business days.

Regional Payment Methods

For traders in Asia, Africa, or Latin America, JustMarkets offers local payment channels such as:

-

Local bank transfers and mobile wallets.

-

Payment agents available in certain regions for faster local deposits.

-

Virtual accounts in specific countries that allow “instant” deposits via domestic banking networks.

Minimums, Fees, and Processing Times

-

Minimum Deposit: Starts from $10, depending on account type and payment method.

-

Fees: JustMarkets typically charges no internal commission on deposits, but third-party fees may apply.

-

Processing Time:

-

Bank cards & e-wallets: Instant to 30 minutes.

-

Crypto: Usually under an hour.

-

Bank transfers: 1–6 business days.

-

Step-by-Step Deposit Process

-

Log in to your JustMarkets Personal Area.

-

Go to Funding → Deposit.

-

Choose your trading account and payment method.

-

Enter the desired amount and confirm the payment.

-

Funds will appear in your trading account once processed.

Withdrawal Methods and Rules

Supported Withdrawal Options

JustMarkets supports the same set of payment methods for withdrawals to ensure a consistent process:

-

Bank Cards (Visa/MasterCard): Withdraw back to the card used for deposit.

-

E-Wallets: Skrill, Neteller, Perfect Money, and others, often processed within hours.

-

Cryptocurrencies: Fast and borderless withdrawals for global traders.

-

Bank Transfers: Common for large sums, though slower due to intermediary banks.

Withdrawal Policies

To ensure safety and compliance, JustMarkets enforces several important rules:

-

Withdrawals should be made using the same method used for deposit, up to the deposit amount.

-

KYC verification is mandatory before withdrawal approval.

-

Third-party transactions (using someone else’s payment account) are not allowed.

Withdrawal Step-by-Step

-

Log in to your Personal Area.

-

Click Funding → Withdrawal.

-

Select your account and withdrawal method.

-

Enter the amount and confirm via security code if required.

-

Wait for finance team approval and transfer to your payment provider.

Typical Processing Times

-

E-Wallets & Crypto: Within 1–2 hours after approval.

-

Bank Cards: May take 1–7 business days depending on issuing bank.

-

Bank Wires: 1–6 business days depending on country.

Regional Insights

Asia

JustMarkets offers regional virtual accounts and local transfer networks that enable instant deposits in selected Asian countries. These methods minimize transfer fees and currency conversion costs.

Africa & Latin America

Local payment agents and mobile money systems are supported in many countries, providing cost-efficient and fast transactions.

Currency Conversion

If you deposit in a currency different from your account’s base currency, conversion will occur automatically. Always check rates before funding to avoid unexpected costs.

Fees, Limits, and Important Notes

While JustMarkets does not charge deposit or withdrawal fees, here are details to watch:

-

Third-Party Provider Fees: Your payment provider may charge service or conversion fees.

-

Currency Exchange: Some methods convert automatically based on real-time rates.

-

Minimum Withdrawal: Usually $10 or equivalent, depending on method.

-

Limitations: Withdrawals must follow AML rules and match previous deposit methods.

Best Practices for Smooth Funding

1. Complete Verification Early

Verify your account as soon as you register to avoid delays when withdrawing funds.

2. Use the Same Method for Deposits and Withdrawals

This ensures compliance and speeds up approval.

3. Keep Transaction Proofs

Save receipts and screenshots in case you need to verify transactions later.

4. Prefer Fast Payment Systems

If you need instant access, e-wallets and crypto are faster than bank wires.

5. Check Regional Availability

Not all methods are available everywhere; confirm via your JustMarkets dashboard.

6. Understand Conversion Fees

Even small exchange rate differences can affect your effective deposit amount.

Common Issues and Troubleshooting

Deposit Not Showing Up

-

Check if you clicked the final confirmation button after payment.

-

Wait for provider processing time (especially on weekends).

-

Contact support if funds don’t appear after the stated time.

Withdrawal Delayed or Rejected

Common reasons include incomplete KYC verification, method mismatch, or using third-party payment details. Always withdraw to the same method and name registered on your account.

Payment Method Not Available

If your preferred method isn’t listed, check for local payment agents or alternative methods provided in your region.

Why Reliable Funding Defines a Good Broker

Efficient deposit and withdrawal systems aren’t just convenience features — they’re proof of operational integrity.

Here’s why they matter:

-

Smooth transactions reflect the broker’s transparency and financial stability.

-

Fast processing allows traders to capitalize on real-time opportunities.

-

Easy withdrawals ensure traders can manage profits confidently.

-

Localized options make global participation accessible for everyone.

JustMarkets continues to strengthen its global infrastructure, ensuring traders can fund and withdraw safely no matter where they are.

Related Guides

Enhance your knowledge with these related resources:

Trade Globally with Secure Funding

JustMarkets continues to position itself as a globally trusted broker by providing transparent, fast, and secure funding systems.

With a wide selection of payment methods — from bank cards to crypto — and consistent policies across regions, traders can fund accounts and withdraw profits with confidence.

To make the most of your trading journey:

-

Verify your account early.

-

Choose payment methods that suit your speed and cost preferences.

-

Always comply with withdrawal rules to ensure smooth transactions.

By mastering JustMarkets’ funding system, you eliminate unnecessary friction and gain the freedom to focus on what really matters — trading successfully in the global forex market.