USD/CHF Forecast – Why the Dollar Recovery Is Stalling at 0.8080 Support

In this article we will explore why the US Dollar (USD) is finding it difficult to push higher against the Swiss Franc (CHF), focusing on the key technical level around 0.8080, the economic and sentiment-driven factors at play, and the implications for traders and investors.

Overview of the USD/CHF Pair and Current Market Environment

What is USD/CHF and why it matters

The USD/CHF currency pair represents the value of one US Dollar in terms of the Swiss Franc. It is one of the major currency pairs in the forex market and is often used as a barometer of risk sentiment. Because the Swiss Franc is considered a safe-haven currency, movements in USD/CHF often reflect shifts in global investor sentiment.

Recent performance and current level

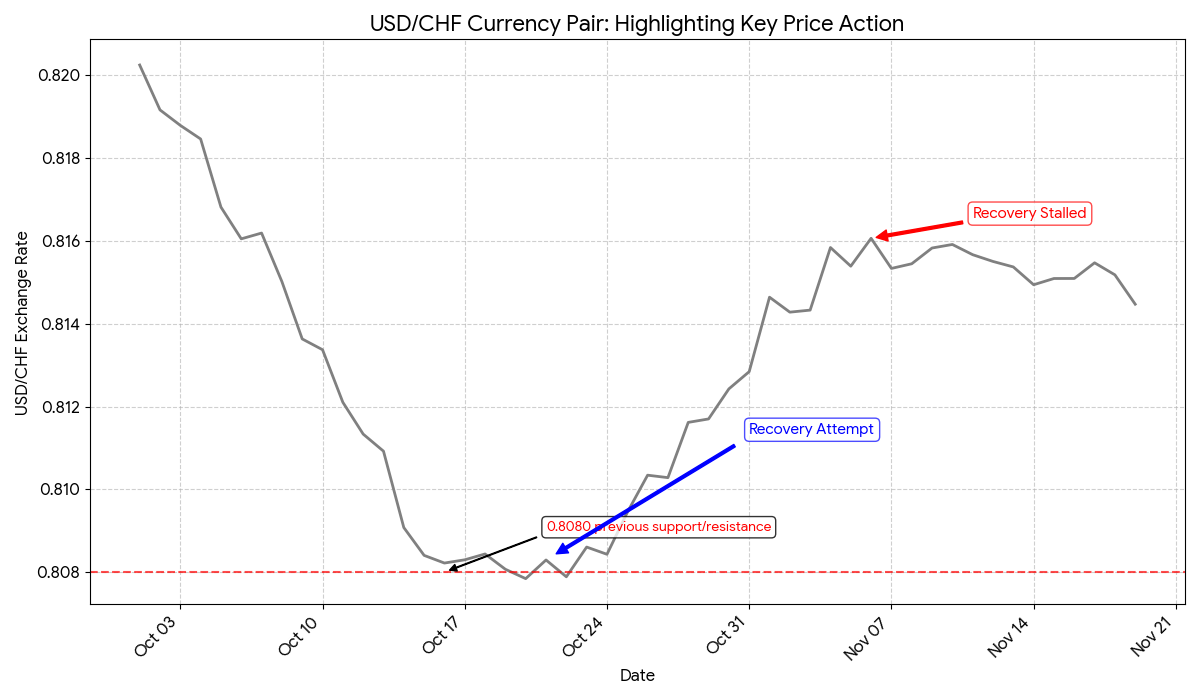

According to FXStreet, the USD/CHF recovery is currently “stalled” just below the 0.8080 level, which had previously acted as support for the pair. The pair trimmed earlier losses but remains capped near this technical barrier. This suggests that while the dollar attempted to rebound, it ran into resistance at the former support zone.

Why this matters for traders and investors

When a currency pair such as USD/CHF fails to regain a former support level, it signals that seller pressure or safe-haven demand (for CHF) remains strong. For traders, this creates a decision point: will the pair break above 0.8080 (implying further dollar strength) or will it reverse and re-test lower supports (implying dollar weakness / CHF strength)? Understanding the underlying drivers helps in planning entries, stop-losses, and take-profit levels.

Key Drivers Behind the USD/CHF Stall at 0.8080

Safe-haven flows and risk sentiment

One major factor wearing on the USD/CHF pair is risk sentiment. In times of global uncertainty, the Swiss Franc gains ground as investors seek a safe refuge. The fact that USD/CHF is struggling around a key level suggests that risk-off conditions (which typically favour the CHF) remain influential.

Technical levels – 0.8080 as former support-turned-resistance

The level of 0.8080 is key because it previously acted as a support point. When such a level is broken and then acts as resistance on a rebound attempt, it becomes psychologically and technically significant. FXStreet noted that the dollar recovery “stalls at the 0.8080 previous support.” FXStreet

For technical traders, this means extra caution: a failed breakout might lead to a retest of lower supports (for example, the 0.7939 level in earlier months). FXStreet+1

Macro-economic factors affecting USD and CHF

Several macro variables are at play:

-

US Dollar strength or weakness hinges on US economic data, interest rate expectations from the Federal Reserve (Fed), and overall global risk appetite.

-

The Swiss Franc is influenced by safe-haven demand, Swiss economic conditions, and the monetary policy stance of the Swiss National Bank (SNB).

If the USD weakens due to disappointing US data or dovish Fed signals, while the CHF remains strong, then USD/CHF could struggle to climb higher.

Market psychology – support becomes resistance

A subtle but important psychological component: when the market perceives a previous support level as broken, attempts to rally back often meet resistance. Traders who view the 0.8080 mark as a “ceiling” may trigger sell orders, while buyers hesitate until a clear breakout occurs.

Technical Outlook – Chart Levels, Scenarios & Trade Ideas

Key support and resistance zones

Here are the main levels to watch for USD/CHF:

-

Resistance: ~0.8080 (previous support) — the current “ceiling”.

-

Support: ~0.7939 (recent low) as cited in previous reports.

-

Additional support: Near 0.7900 or the yearly low of ~0.7829 (mentioned in earlier forecasts).

Scenario 1 – Breakout above 0.8080

If the USD/CHF pair breaks and holds above 0.8080, one could argue that a dollar recovery is underway. In that scenario:

-

Look for confirmation with a close above 0.8080 on daily chart.

-

A possible next target might be nearer 0.8100 or beyond.

-

Traders might choose a long (buy) position, with stop-loss just below 0.8080, and take-profit at next resistance zone.

Scenario 2 – Failure at 0.8080 and reversal

If the pair fails to clear 0.8080 and instead turns lower:

-

A decent trade idea might be a short (sell) with confirmation of resistance holding.

-

Target support zones: 0.7939 first, then 0.7900, potentially down to ~0.7829.

-

Stop-loss would be placed just above 0.8080 or a nearby high.

Risk management and stop-loss considerations

Given the potential for volatility (safe-haven flows, surprise data), traders should:

-

Limit position size relative to account equity.

-

Use stop-loss orders rather than no risk control.

-

Consider using lower leverage when trading USD/CHF, given its susceptibility to macro shocks.

Educational Takeaways – What Traders Can Learn from This Case

Importance of previous support/resistance flip

The USD/CHF example reinforces how a level that once provided support can become a barrier when broken, as seen at 0.8080. Recognising these “role‐reversal” levels is an important technical skill.

Sentiment and fundamentals drive technical outcomes

Even the best technical setup (such as a support level) won’t always hold if underlying sentiment is working against it. Here, safe-haven demand for CHF and a cautious mood in markets prevented USD/CHF from recovering strongly.

Always plan for both breakout and reversal

A prudent trader should plan for both possibilities: the breakout scenario and the reversal scenario, defining entry, stop loss and take profit for each. This dual-scenario planning improves readiness and reduces emotional bias.

Use multiple timeframes and confirm signals

While the daily chart may show a close above/below 0.8080, always check shorter time-frames (4-hour, 1-hour) for confirmation of momentum, volume (where applicable), and candlestick patterns. This helps filter false breakouts.

Never neglect the risk of macro surprises

A sudden shift in economic data, central-bank commentary or geopolitical developments can upset the trade plan. Always stay updated with economic calendars, central-bank meetings, and global news.

Implications for Traders & Investors in USD/CHF

For short-term traders

Short-term scalpers or intraday traders may want to monitor the 0.8080 barrier closely and look for signs of rejection (e.g., bearish engulfing candle, strong spike higher failing to hold). A quick fade from 0.8080 could offer short-term opportunities.

For swing traders

Swing traders who hold positions for a few days to weeks should consider broader trends: if USD/CHF remains below 0.8080 and breaks down below 0.7939, that may signal a deeper dollar weakness phase. Conversely, a convincing breakout might signal a recovery trade.

For investors

Investors taking longer-term views should recognize that USD/CHF is influenced not only by technical levels but also by global risk sentiment and monetary policy differentials. If one expects a risk-off environment, CHF strength might persist; if risk appetite recovers and US data improves, USD might regain mojo.

Broker and platform considerations

When trading pairs like USD/CHF (major currency pair), ensure you’re using a regulated broker with competitive spreads, good execution speed, and appropriate risk-management tools. Given your interest in forex brokers (as I recall you’re often asking about them), ensure the broker supports the pair and offers proper leverage and margin rules for your region (Indonesia / Asia-Pacific).

Summary and Key Takeaways

-

The USD/CHF pair is currently stalled around the 0.8080 level, which previously acted as support but now is acting as resistance.

-

Safe-haven demand for the Swiss Franc, cautious market sentiment, and technical structure are combining to limit the dollar’s recovery.

-

The key levels: resistance ~0.8080, support ~0.7939, and possible deeper support ~0.7900 or ~0.7829.

-

Traders should prepare for two scenarios: breakout above 0.8080 (bullish USD) or failure and reversal (bearish USD / stronger CHF).

-

Risk management is essential: use stop-losses, monitor macro developments, confirm signals on multiple time-frames.

-

The USD/CHF case teaches important lessons about support-turned-resistance flips, the inter-play of fundamentals and technicals, and the need for planning both ways.

Final Remarks

In the fast-moving forex market, pairs like USD/CHF can quickly swing based on macro signals, sentiment shifts, or technical trigger points. The current struggle around 0.8080 is a teachable moment: it’s not enough to identify a level, one must also understand the underlying forces that will make that level hold (or fail). Whether you’re a day-trader, swing-trader, or long-term investor, aligning your strategy with the behaviour of the pair, managing risk, and staying emotionally detached will improve your odds.