Choosing the right broker can make all the difference in your trading journey. In this comprehensive IC Markets review, we’ll examine everything from trading platforms and account types to fees, regulation, and user experience. Founded in 2007, IC Markets has established itself as a major player in the online trading space, particularly for forex and CFD traders. But is it the right broker for your specific needs? Let’s dive deep into what IC Markets offers and help you make an informed decision.

Company Overview and Background

IC Markets was established in 2007 in Sydney, Australia, by a team of financial experts with extensive experience in the derivatives markets. The company was founded with a vision to provide traders with institutional-grade liquidity and pricing, advanced trading tools, and a transparent trading environment.

Over the years, IC Markets has grown to become one of the world’s largest forex CFD providers by trading volume. As of 2025, the broker reports monthly trading volumes exceeding $1.5 trillion across its global client base of over 200,000 active traders.

The company operates through several regulated entities worldwide:

- International Capital Markets Pty Ltd (Australia)

- IC Markets (EU) Ltd (Cyprus)

- Raw Trading Ltd (Seychelles)

- IC Markets Ltd (Bahamas)

- IC Markets (KE) Ltd (Kenya)

This multi-jurisdiction approach allows IC Markets to serve clients globally while maintaining regulatory compliance in various regions. However, it’s worth noting that the broker does not accept clients from certain countries, including the United States, Canada, Brazil, Japan, New Zealand, and Israel.

Regulation and Security Measures

When evaluating any broker, regulation and security should be top priorities. IC Markets operates under multiple regulatory frameworks, providing varying levels of protection depending on which entity holds your account.

| Entity | Regulatory Authority | License Number | Regulatory Tier |

| International Capital Markets Pty Ltd | Australian Securities & Investments Commission (ASIC) | AFSL 335692 | Tier 1 (High Trust) |

| IC Markets (EU) Ltd | Cyprus Securities and Exchange Commission (CySEC) | 362/18 | Tier 1 (High Trust) |

| Raw Trading Ltd | Financial Services Authority (FSA) Seychelles | SD018 | Tier 3 (Average Risk) |

| IC Markets Ltd | Securities Commission of The Bahamas (SCB) | SIA-F214 | Tier 3 (Average Risk) |

| IC Markets (KE) Ltd | Capital Markets Authority (CMA) Kenya | 199 | Tier 3 (Average Risk) |

Client Protection Measures

IC Markets implements several security measures to protect client funds:

- Segregated Client Accounts: All client funds are held in segregated accounts with top-tier banks, separate from the company’s operational funds.

- Negative Balance Protection: Available for clients of the Australian (ASIC) and European (CySEC) entities, ensuring you cannot lose more than your account balance.

- Investor Compensation: EU clients are covered by the Cyprus Investor Compensation Fund (ICF) for up to €20,000 in the unlikely event of broker insolvency.

- Indemnity Insurance: The Seychelles entity provides indemnity insurance of up to $1,000,000.

Trade with a Regulated Broker

Open an account with IC Markets and enjoy the security of trading with a broker regulated by top-tier authorities.

Trading Platforms Offered

IC Markets provides access to several industry-leading trading platforms, catering to different trading styles and preferences. Each platform comes with its own unique features and capabilities.

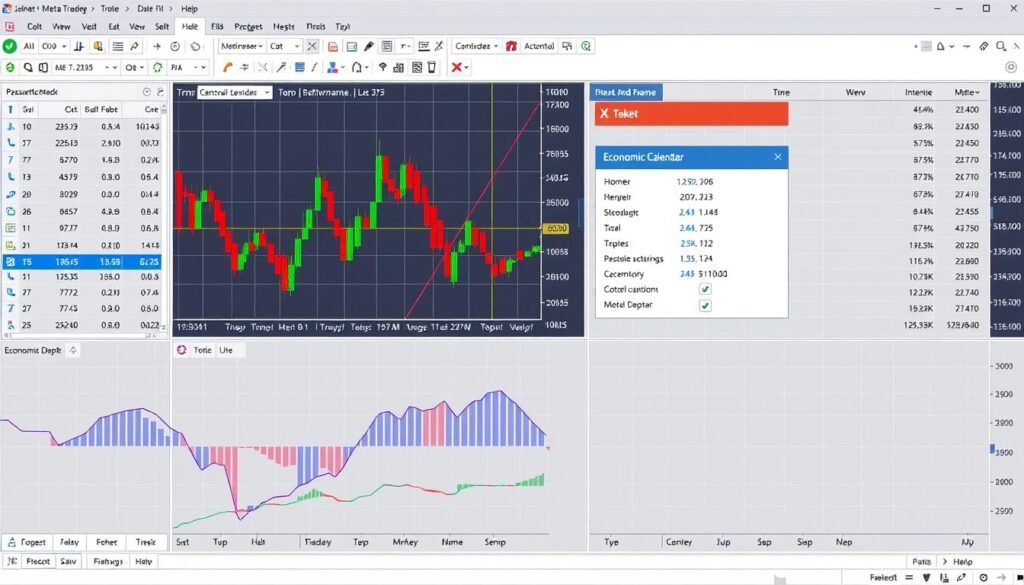

MetaTrader 4 (MT4)

The industry-standard platform known for its reliability and extensive features:

- User-friendly interface with customizable charts

- 30+ built-in technical indicators

- Support for Expert Advisors (EAs) for automated trading

- Available on desktop (Windows/Mac), web, and mobile

- One-click trading functionality

MetaTrader 5 (MT5)

An advanced version of MT4 with enhanced features:

- Access to more markets including stocks and futures

- 38 technical indicators and 44 analytical objects

- Economic calendar integration

- Advanced Market Depth (DOM) trading

- Improved backtesting capabilities

- Support for both hedging and netting account types

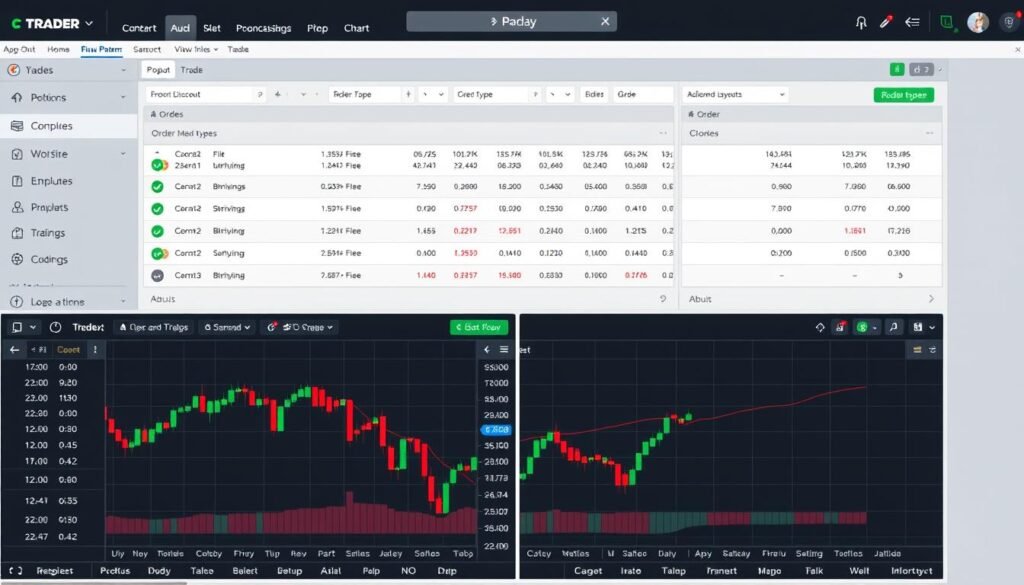

cTrader

A sophisticated ECN platform designed for advanced traders:

- Full market depth visibility

- Advanced order types and execution

- cAlgo for automated trading strategies

- Detachable charts and customizable layouts

- Advanced technical analysis tools

- Available on desktop, web, and mobile

TradingView Integration

IC Markets also offers integration with TradingView, a popular charting platform known for its advanced technical analysis tools and social trading features:

- Superior charting capabilities with over 100 drawing tools

- 400+ built-in indicators and thousands of community-created indicators

- Pine Script for creating custom indicators

- Social trading community with shared ideas

- Trade directly from the chart interface

- Cloud-based platform accessible from any device

Social and Copy Trading Options

For traders interested in social and copy trading, IC Markets provides several options:

- ZuluTrade: Connect with over 100,000 signal providers from 192 countries

- IC Social: IC Markets’ proprietary mobile app for social trading

- Signal Start: Copy trading platform for MetaTrader users

- cTrader Copy: Built-in copy trading functionality in cTrader

Experience IC Markets' Trading Platforms

Try out any of IC Markets’ advanced trading platforms with a risk-free demo account.

Account Types and Features

IC Markets offers several account types to cater to different trading styles and preferences. Each account type comes with its own fee structure, platform availability, and features.

| Feature | Standard Account | Raw Spread Account | cTrader Raw Account |

| Minimum Deposit | $50 | $100 | $200 |

| Spreads From | 0.8 pips | 0.0 pips | 0.0 pips |

| Commission | None | $7 per round turn (1 lot) | $6 per round turn (1 lot) |

| Available Platforms | MT4, MT5 | MT4, MT5, TradingView | cTrader, MT4, MT5, TradingView |

| Base Currencies | USD, EUR, GBP, AUD, NZD, SGD, CAD, CHF, JPY, HKD | USD, EUR, GBP, AUD, NZD, SGD, CAD, CHF, JPY, HKD | USD, EUR, GBP, AUD, NZD, SGD, CAD, CHF, JPY, HKD |

| Leverage (Max) | Up to 1:500 (varies by entity) | Up to 1:500 (varies by entity) | Up to 1:500 (varies by entity) |

| Position Limit | 200 | 200 | 2,000 |

| Ideal For | Beginners, casual traders | Active traders, scalpers | Professional traders, algo traders |

Specialized Account Options

Islamic (Swap-Free) Accounts

IC Markets offers swap-free accounts that comply with Islamic Sharia law, which prohibits the payment or receipt of interest (riba). These accounts are available across all main account types and don’t incur overnight swap charges on most instruments.

Note: Some instruments like exotic currency pairs and certain commodities may still incur a small flat fee for positions held overnight.

MAM/PAMM Accounts

For money managers and professional traders, IC Markets provides Multi-Account Manager (MAM) and Percentage Allocation Management Module (PAMM) solutions. These accounts allow for:

- Managing multiple client accounts simultaneously

- Flexible allocation methods

- Real-time reporting of performance and commissions

- Support for expert advisors and algorithmic trading

Demo Accounts

IC Markets offers unlimited free demo accounts that accurately simulate real trading conditions. These accounts are ideal for:

- Testing trading strategies without financial risk

- Familiarizing yourself with the various trading platforms

- Practicing with virtual funds before committing real capital

- Exploring different account types to find the best fit

Find the Right Account for Your Trading Style

Compare IC Markets’ account options and choose the one that best suits your trading needs.

Trading Instruments Available

IC Markets offers a diverse range of trading instruments across multiple asset classes, allowing traders to diversify their portfolios and take advantage of various market opportunities.

| Asset Class | Number of Instruments | Examples | Leverage (Max) |

| Forex | 61 pairs | EUR/USD, GBP/JPY, AUD/CAD, Exotic pairs | 1:500 |

| Commodities | 26 | Gold, Silver, Oil, Natural Gas, Agricultural products | 1:500 |

| Indices | 24 | S&P 500, NASDAQ, DAX 40, FTSE 100, Nikkei 225 | 1:200 |

| Stocks (CFDs) | 2,100+ | Apple, Tesla, Amazon, Microsoft, Meta | 1:20 |

| Cryptocurrencies | 19 | Bitcoin, Ethereum, Litecoin, Ripple, Cardano | 1:5 to 1:20 |

| Bonds | 9 | US T-Bond, UK Gilt, Euro Bund, Japan JGB | 1:200 |

Forex Trading

IC Markets is particularly known for its forex offering, with competitive spreads on major, minor, and exotic currency pairs. The broker provides deep liquidity from multiple tier-1 banks and non-bank liquidity providers, ensuring fast execution and minimal slippage even during volatile market conditions.

CFD Trading

All non-forex instruments at IC Markets are offered as Contracts for Difference (CFDs), which allow traders to speculate on price movements without owning the underlying asset. Benefits of CFD trading include:

- Ability to go long (buy) or short (sell) on any instrument

- Trading with leverage to amplify potential returns

- No ownership costs or stamp duties

- Access to markets that might otherwise be difficult to trade

Important: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Spreads, Commissions, and Trading Costs

Trading costs are a crucial factor when choosing a broker, as they directly impact your bottom line. IC Markets is known for its competitive pricing structure, particularly for its Raw Spread accounts.

Spreads

IC Markets offers some of the tightest spreads in the industry, especially on its Raw Spread accounts:

| Instrument | Standard Account (Avg) | Raw Spread Account (Avg) | Industry Average |

| EUR/USD | 0.82 pips | 0.02 pips | 1.08 pips |

| GBP/USD | 1.03 pips | 0.23 pips | 1.37 pips |

| USD/JPY | 0.94 pips | 0.14 pips | 1.06 pips |

| Gold (XAU/USD) | 21 pips | 15 pips | 23 pips |

| S&P 500 | 0.7 points | 0.5 points | 0.8 points |

| Bitcoin (BTC/USD) | $12 | $12 | $34 |

Commissions

While the Standard Account has no commission (costs are built into the spread), the Raw Spread accounts charge a commission per round turn (opening and closing a position):

- Raw Spread Account (MT4/MT5): $7.00 per round turn per standard lot (100,000 units)

- cTrader Raw Account: $6.00 per round turn per standard lot (100,000 units)

For perspective, a 1 lot EUR/USD trade on the Raw Spread Account would cost approximately:

- Spread cost: 0.02 pips × $10 per pip = $0.20

- Commission: $7.00 per round turn

- Total cost: $7.20

The same trade on the Standard Account would cost approximately:

- Spread cost: 0.82 pips × $10 per pip = $8.20

- Commission: $0

- Total cost: $8.20

Overnight Financing (Swaps)

For positions held overnight, IC Markets charges or credits swap rates based on the interest rate differential between the two currencies in a pair. These rates can be positive (you receive) or negative (you pay) depending on the direction of your trade and the underlying interest rates.

Swap rates vary by instrument and are subject to change based on market conditions. They are calculated as points and automatically converted to your account currency.

Non-Trading Fees

IC Markets stands out for its transparent fee structure with minimal non-trading fees:

- Deposit Fees: None (though third-party payment processors may charge fees)

- Withdrawal Fees: None (though banks may charge for international transfers)

- Inactivity Fees: None

- Account Maintenance Fees: None

Experience Low-Cost Trading

Open an account with IC Markets and take advantage of ultra-low spreads and competitive commissions.

Deposit and Withdrawal Methods

IC Markets offers a wide range of deposit and withdrawal options to accommodate traders from different regions. All methods are fee-free from IC Markets’ side, though third-party providers may charge their own fees.

Deposit Methods

- Credit/Debit Cards: Visa, Mastercard (Instant)

- Bank Wire Transfer: International and domestic (1-3 business days)

- Electronic Payment Systems:

- PayPal (Instant)

- Skrill (Instant)

- Neteller (Instant)

- UnionPay (Instant)

- Klarna (Up to 2 business days)

- Rapid Transfer (Up to 2 business days)

- Local Payment Methods:

- BPAY (Australia, 12-48 hours)

- POLi (Australia, Instant)

- Thai Internet Banking (15-30 minutes)

- Vietnamese Internet Banking (Instant)

- Broker-to-Broker Transfer: 2-5 business days

Withdrawal Methods

Withdrawals are processed through the same methods used for deposits, with processing times as follows:

- Credit/Debit Cards: Up to 24 hours

- Bank Wire Transfer: 2-7 business days

- Electronic Payment Systems: Up to 24 hours

- Local Payment Methods: 12-48 hours

- Broker-to-Broker Transfer: 2-5 business days

Key points about withdrawals:

- No withdrawal fees charged by IC Markets

- Withdrawals are typically processed within 24 hours

- Funds are returned to the same source used for deposit (anti-money laundering requirement)

- Verification may be required for large withdrawals

Base Currencies

IC Markets offers a wide range of base currencies for your trading account, helping you avoid unnecessary conversion fees:

- USD (US Dollar)

- EUR (Euro)

- GBP (British Pound)

- AUD (Australian Dollar)

- NZD (New Zealand Dollar)

- SGD (Singapore Dollar)

- CAD (Canadian Dollar)

- CHF (Swiss Franc)

- JPY (Japanese Yen)

- HKD (Hong Kong Dollar)

Customer Support Quality and Availability

Reliable customer support is essential when trading in financial markets, especially during volatile periods or when facing technical issues. IC Markets offers 24/7 multilingual support through various channels.

Support Channels

Live Chat

Available 24/7 directly from the IC Markets website. This is the fastest way to get assistance, with typical response times under 1 minute.

Email Support

For more detailed inquiries, you can email support@icmarkets.com. Response times typically range from 1-24 hours depending on the complexity of the issue.

Phone Support

IC Markets offers phone support through several international numbers:

- General: +248 467 19 76

- Regional numbers available for Thailand, Indonesia, Colombia, Vietnam, and South Africa

Supported Languages

IC Markets provides support in multiple languages to serve its global client base:

- English

- Spanish

- Portuguese

- Arabic

- Thai

- Vietnamese

Support Quality

Based on our testing and user feedback, IC Markets’ customer support is generally rated highly for:

- Knowledge and expertise of support agents

- Quick response times across all channels

- Ability to resolve complex technical and account issues

- Professionalism and courtesy

Areas where some users have reported room for improvement include:

- Occasional delays during peak market hours

- Varying quality of support between different regional offices

“I’ve been trading with IC Markets for over three years now, and their customer support has always been responsive and helpful. When I had an issue with a withdrawal, they resolved it within hours.”

– Michael T., Forex Trader

Educational Resources and Tools

IC Markets provides a range of educational materials to help traders of all experience levels improve their knowledge and skills. While not as extensive as some competitors, the quality of content has improved significantly in recent years.

Educational Content

Articles and Guides

IC Markets offers over 100 written articles covering various trading topics, including:

- Forex Trading 101

- Technical Analysis

- Fundamental Analysis

- Risk Management

- Trading Psychology

- Platform Tutorials

Video Content

The broker’s YouTube channel hosts numerous educational videos, including:

- Platform tutorials

- Trading strategy demonstrations

- Market analysis

- Webinar recordings

- “IC Your Trade” podcast series

Webinars

IC Markets regularly hosts live webinars covering:

- Current market analysis

- Trading strategies

- Platform features

- Risk management techniques

- Q&A sessions with experienced traders

Trading Tools

In addition to educational content, IC Markets provides several tools to assist with market analysis and trading decisions:

Trading Central

IC Markets offers free access to Trading Central, a leading provider of technical analysis and research. Features include:

- Daily technical analysis across multiple timeframes

- Trading signals with entry, stop loss, and take profit levels

- Economic calendar with market impact ratings

- Analyst views on major market events

Autochartist

This powerful pattern recognition tool is available to IC Markets clients, offering:

- Automated chart pattern identification

- Real-time trading opportunities

- Quality indicators for identified patterns

- Market volatility analysis

- Integration with MetaTrader platforms

Market Analysis

IC Markets provides regular market analysis to help traders stay informed about current market conditions:

- Daily market commentary

- Weekly market outlook

- Technical and fundamental analysis

- Economic calendar with upcoming events

- Special reports on major market events

Enhance Your Trading Knowledge

Access IC Markets’ educational resources and improve your trading skills with a free demo account.

Mobile Trading Experience

In today’s fast-paced trading environment, having reliable mobile trading capabilities is essential. IC Markets offers mobile versions of all its trading platforms, allowing traders to monitor and manage their positions on the go.

Available Mobile Apps

MetaTrader 4 Mobile

Available for iOS and Android devices, offering:

- Full trading functionality

- Real-time quotes and charts

- 30 technical indicators

- Multiple timeframes

- One-click trading

- Push notifications for price alerts

MetaTrader 5 Mobile

The advanced version for iOS and Android with:

- Enhanced charting capabilities

- Economic calendar integration

- Market depth information

- 38 technical indicators

- Multiple order types

- Financial news

cTrader Mobile

A sophisticated mobile trading experience with:

- Advanced charting tools

- Full market depth visibility

- Customizable interface

- One-tap trading

- 65 technical indicators

- Detachable charts

IC Social Mobile App

In addition to the standard trading platforms, IC Markets offers IC Social, a proprietary mobile app powered by Pelican Exchange that focuses on social and copy trading:

- Follow and copy successful traders

- View detailed performance statistics

- Interact with other traders

- Share trading ideas and strategies

- Monitor copied trades in real-time

- Adjust copy settings on the go

Mobile Trading Performance

Based on user feedback and our testing, IC Markets’ mobile trading apps perform well in terms of:

- Stability and reliability

- Execution speed

- User interface and navigation

- Feature parity with desktop versions

- Battery consumption

However, it’s worth noting that IC Markets does not offer a proprietary mobile trading app (unlike some competitors like IG or Saxo Bank), instead relying on the mobile versions of third-party platforms.

Pros and Cons Analysis

Pros

- Ultra-low spreads – Among the tightest in the industry, especially on Raw Spread accounts

- Multiple regulated entities – Including top-tier regulators like ASIC and CySEC

- Excellent platform selection – MT4, MT5, cTrader, and TradingView cover all trading needs

- Deep liquidity – True ECN execution with no dealing desk intervention

- No non-trading fees – No charges for deposits, withdrawals, or inactive accounts

- Extensive instrument range – Over 2,200 tradable instruments across multiple asset classes

- Advanced trading tools – Including Trading Central and Autochartist

- Social and copy trading options – Through ZuluTrade, IC Social, and cTrader Copy

- 24/7 customer support – Available via multiple channels and languages

- Suitable for algorithmic trading – With VPS hosting options and API access

Cons

- Limited educational content – Not as comprehensive as some competitors

- No proprietary trading platform – Relies entirely on third-party platforms

- No proprietary mobile app – Uses mobile versions of third-party platforms

- High swap rates – Overnight financing charges can be higher than industry average

- Limited research tools – Market analysis could be more extensive

- Platform limitations by account type – Standard account doesn’t support cTrader or TradingView

- No FCA regulation – No access to UK’s Financial Services Compensation Scheme

- Geographic restrictions – Not available to residents of US, Canada, Japan, and several other countries

- Variable protection by entity – Negative balance protection only available with certain entities

Comparison with Other Major Brokers

To provide context on how IC Markets stacks up against the competition, we’ve compared it with several other popular forex and CFD brokers across key metrics.

| Feature | IC Markets | Pepperstone | IG | XTB |

| Min. Deposit | $200 | $200 | $250 | $0 |

| EUR/USD Spread (Avg) | 0.02 pips + commission | 0.09 pips + commission | 0.6 pips | 0.1 pips + commission |

| Commission (Standard Lot) | $7.00 | $7.00 | $0 (included in spread) | $8.00 |

| Number of Forex Pairs | 61 | 60+ | 80+ | 48 |

| Total Instruments | 2,200+ | 1,200+ | 17,000+ | 5,500+ |

| Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView | MT4, ProRealTime, IG Platform | MT4, xStation 5 |

| Max Leverage | 1:500 (offshore) | 1:500 (offshore) | 1:200 (offshore) | 1:200 (offshore) |

| Proprietary Platform | No | No | Yes | Yes |

| Education | Good | Good | Excellent | Excellent |

| Research | Good | Very Good | Excellent | Very Good |

| Customer Support | 24/7 | 24/5 | 24/5 | 24/5 |

Key Competitive Advantages

Based on this comparison, IC Markets’ main competitive advantages include:

- Ultra-low spreads that are among the best in the industry

- Excellent platform selection with all major third-party platforms available

- 24/7 customer support (many competitors offer only 24/5)

- Strong focus on ECN execution and deep liquidity

- High maximum leverage through offshore entities

Areas Where Competitors Excel

Areas where some competitors have an edge over IC Markets include:

- IG offers a much wider range of tradable instruments (17,000+)

- IG and XTB provide proprietary trading platforms

- IG and XTB offer more comprehensive educational resources

- Some competitors have more extensive research tools and market analysis

- XTB has a lower minimum deposit requirement ($0)

Overall Rating and Final Verdict

Final Verdict

IC Markets stands out as an excellent broker for traders who prioritize competitive pricing, fast execution, and platform variety. With some of the industry’s lowest spreads, true ECN execution, and support for popular platforms like MetaTrader and cTrader, it’s particularly well-suited for active traders, scalpers, and those using automated trading strategies.

The broker’s multi-jurisdiction regulation provides a reasonable level of security, though the protection varies depending on which entity holds your account. The absence of non-trading fees (deposit, withdrawal, inactivity) is another significant advantage.

While IC Markets offers a good range of educational resources and research tools, these areas aren’t as comprehensive as some competitors. Similarly, the lack of a proprietary trading platform or mobile app might be a drawback for some traders.

Who Is IC Markets Best For?

Highly Recommended For:

- Active forex and CFD traders seeking tight spreads

- Scalpers and high-frequency traders

- Algorithmic traders using Expert Advisors

- Traders who prefer MetaTrader or cTrader platforms

- Traders looking for deep liquidity and fast execution

Suitable For:

- Intermediate to advanced traders

- Day traders and swing traders

- Traders interested in social/copy trading

- Traders who value 24/7 customer support

- Traders seeking a wide range of CFD instruments

Not Ideal For:

- Complete beginners (limited educational resources)

- Traders who prefer proprietary platforms

- Long-term investors (high swap rates)

- Traders seeking extensive research tools

- Residents of restricted countries (US, Canada, etc.)

Ready to Trade with IC Markets?

Open an account today and experience IC Markets’ competitive spreads, fast execution, and versatile trading platforms.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Frequently Asked Questions

Is IC Markets safe and reliable?

Yes, IC Markets is generally considered safe and reliable. The broker operates through multiple regulated entities, including those overseen by top-tier regulators like ASIC (Australia) and CySEC (Cyprus). Client funds are held in segregated accounts with major banks, and negative balance protection is available for clients of certain entities. The broker has been in operation since 2007 and has built a solid reputation in the industry.

What is the minimum deposit for IC Markets?

The minimum deposit required to open a live trading account with IC Markets is 0 (or equivalent in other currencies). This minimum deposit applies to all account types, including Standard, Raw Spread, and cTrader Raw accounts.

Does IC Markets charge fees for deposits and withdrawals?

IC Markets does not charge any fees for deposits or withdrawals. However, third-party payment processors or banks may charge their own fees for certain transactions, particularly for international wire transfers. It’s also worth noting that IC Markets has a policy of returning funds to the same source used for deposits, in compliance with anti-money laundering regulations.

What leverage does IC Markets offer?

The maximum leverage offered by IC Markets varies depending on the regulatory entity holding your account:

- ASIC (Australia) regulated accounts: Up to 1:30 for retail clients

- CySEC (Cyprus) regulated accounts: Up to 1:30 for retail clients

- FSA (Seychelles) regulated accounts: Up to 1:500

- SCB (Bahamas) regulated accounts: Up to 1:200

- CMA (Kenya) regulated accounts: Up to 1:400

Professional clients may be eligible for higher leverage with the ASIC and CySEC regulated entities.

Which trading platforms does IC Markets offer?

IC Markets offers several popular trading platforms:

- MetaTrader 4 (MT4) – Available on all account types

- MetaTrader 5 (MT5) – Available on all account types

- cTrader – Available on Raw Spread and cTrader Raw accounts

- TradingView – Available on Raw Spread and cTrader Raw accounts

All platforms are available in desktop, web, and mobile versions.

Does IC Markets accept clients from the United States?

No, IC Markets does not accept clients from the United States. Other restricted countries include Canada, Brazil, Japan, New Zealand, Israel, North Korea, and Iran. This is primarily due to regulatory restrictions in these jurisdictions.