Choosing the right forex broker can significantly impact your trading success. This OctaFX review examines the broker’s platforms, account types, fees, regulatory status, and overall user experience to help you decide if it matches your trading goals. Founded in 2011, OctaFX also offers low minimum deposits and a range of platform features designed for both new and experienced traders — from demo accounts to advanced platform tools — so you can evaluate the trading experience and accounts that suit you best.

OctaFX Review: Quick Overview

Quick verdict: a beginner-friendly forex broker that also offers advanced platforms for experienced traders — regulated via CySEC (Cyprus) and FSCA (South Africa), with low minimum deposits and multiple platform options to suit different trading styles.

| Feature | Details |

| Founded | 2011 |

| Headquarters | St. Vincent and the Grenadines (Global entity) |

| Regulation | CySEC (Cyprus), FSCA (South Africa) |

| Min. Deposit | $25 |

| Spreads From | 0.6 pips |

| Leverage | Up to 1:1000 (varies by entity) |

| Trading Platforms | MetaTrader 4, MetaTrader 5, OctaTrader |

| Assets | Forex, Cryptocurrencies, Stocks, Indices, Commodities |

| Demo Account | Yes |

| Customer Support | 24/7 via live chat and email |

Note: details such as spreads, regulation status, and available features can vary depending on which OctaFX entity you sign up with. Verify the exact trading conditions and demo accounts availability for your region and selected account before depositing (information is current as of review publication).

Trust and Regulation

Regulation is a key factor when choosing a broker because it determines the level of client protection and the rules the broker must follow. OctaFX operates through several legal entities, each subject to different regulatory oversight depending on the jurisdiction:

- OCTA Markets Cyprus Ltd – Regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 372/18

- Orinoco Capital (Pty) Ltd – Regulated by the Financial Sector Conduct Authority (FSCA) of South Africa under license number 51913

- OCTA Markets Ltd – Registered in St. Vincent and the Grenadines

What this means for traders: regulatory protections differ by entity. Accounts held with the CySEC-regulated entity are subject to EU-style oversight and take part in the Investor Compensation Fund (ICF), which can provide limited protection (up to €20,000) if the firm becomes insolvent. The FSCA-regulated entity follows South Africa’s Financial Sector Conduct Authority rules, which impose local conduct standards and client protection measures appropriate for that market. Accounts with the St. Vincent and the Grenadines-registered entity do not benefit from the same regulatory protections.

OctaFX states it uses standard security measures such as segregated client funds, negative balance protection, and SSL encryption to protect client money and data. As of this review, two-factor authentication (2FA) is not listed among the broker’s security features — confirm current security options on OctaFX’s site before opening an account.

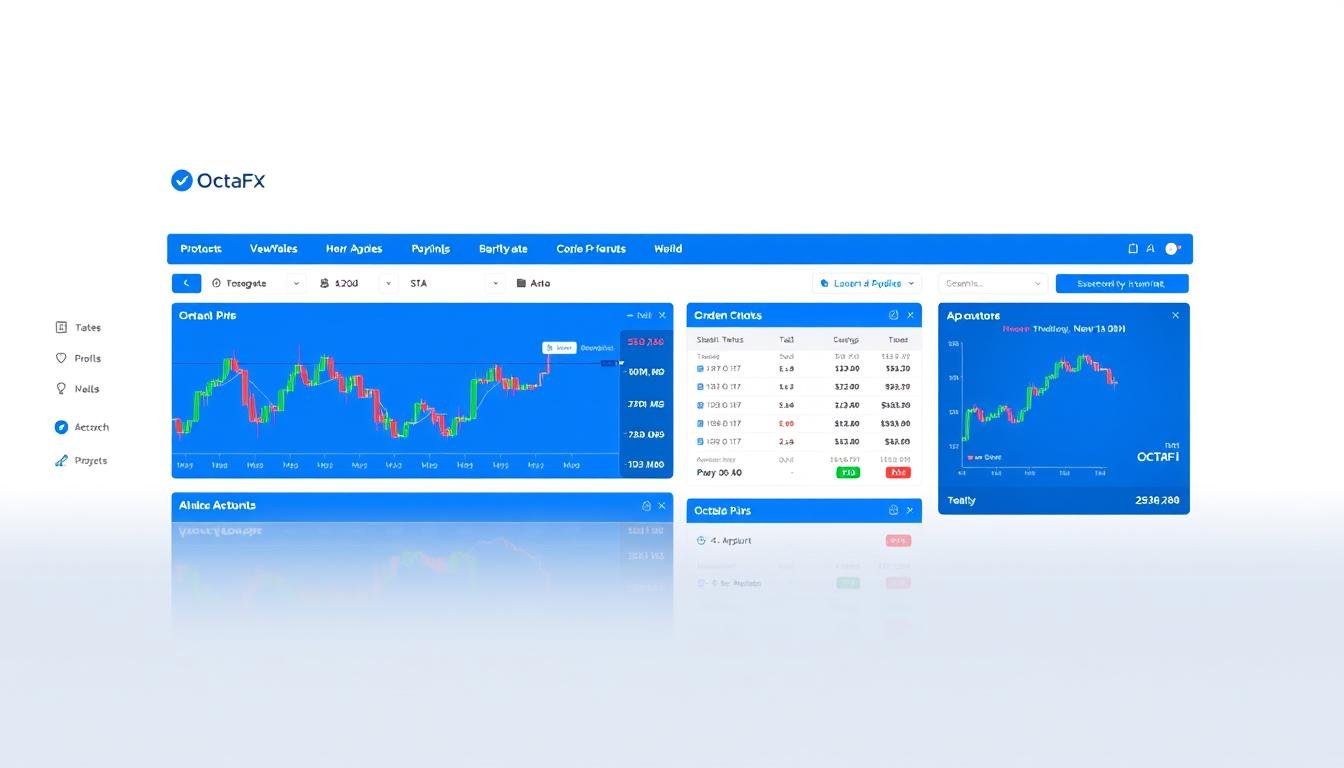

OctaFX Trading Platforms

OctaFX provides three main trading platforms to cover a wide range of trader needs — from beginners who prefer an intuitive web interface to advanced traders requiring algorithmic tools and broader market access. Each platform has distinct strengths, and demo accounts let users test them risk-free.

OctaTrader

OctaTrader is OctaFX’s proprietary web-based platform focused on ease of use and quick access to essential trading tools. Key features include:

- AI-powered OctaVision for performance analytics

- One-click trading and simplified order entry

- Integrated market research through the ‘Space’ feature

- High-definition, easily scalable charts

Best for: new traders and users who want a polished, user-friendly trading platform with built-in analytics and an easy learning curve.

MetaTrader 4 (MT4)

MetaTrader 4 is the industry-standard trading platform favored for forex trading and algorithmic strategies. Highlights include:

- Advanced technical analysis with 30+ built-in indicators

- Support for Expert Advisors (EAs) for automated trading

- Highly customizable charts and interface

- Available on desktop, web, and mobile

Best for: traders who rely on technical analysis, automated strategies, and established third‑party tools (EAs).

MetaTrader 5 (MT5)

MT5 expands on MT4 with multi-asset support and more advanced analysis tools. Key features include:

- Access to more markets, including stock CFDs and (for eligible accounts) real stocks

- 21 timeframes for detailed analysis

- Enhanced backtesting and strategy tester

- Depth of Market (DoM) and a built‑in economic calendar

Best for: advanced traders who need broader market access and more sophisticated analysis tools.

Try OctaFX's Platforms Risk-Free

Not sure which platform fits your trading style? OctaFX offers demo accounts so you can test OctaTrader, MT4, and MT5 with virtual funds before switching to a live account.

Mobile Trading Experience

OctaFX supports mobile trading through its proprietary app and the MetaTrader mobile apps, enabling traders to manage open positions and monitor markets on the go.

OctaFX Trading App

The OctaFX mobile app brings OctaTrader features to smartphones, including:

- Access to OctaTrader functionality and OctaVision analytics

- Real-time quotes and push notifications

- Full account management and order execution

Best for users who want the OctaTrader experience on mobile with integrated broker tools.

MT4/MT5 Mobile Apps

MetaTrader mobile apps (MT4/MT5) provide a portable version of the desktop platforms:

- Technical analysis with indicators and multiple chart types

- Price alerts, trading history, and basic reporting

- Available for both iOS and Android

Best for traders who use EAs or custom indicators and want continuity between desktop and mobile trading.

Note: mobile apps are feature-rich but limited compared with desktop platforms for advanced charting and backtesting. If you rely on extensive analysis or EAs, test functionality on demo accounts first to confirm the mobile experience meets your needs.

OctaFX Account Types

Instead of tiered accounts, OctaFX structures its offering around the trading platform you choose. Each platform-based account has its own set of features, instruments, and trading conditions, so pick the account that matches your preferred tools and markets.

| Feature | OctaTrader Account | MetaTrader 4 Account | MetaTrader 5 Account |

| Minimum Deposit | $25 | $25 | $25 |

| Spreads From | 0.6 pips | 0.6 pips | 0.6 pips |

| Commission | $0 | $0 | $0 |

| Base Currency | USD | USD | USD |

| Leverage | Up to 1:1000* | Up to 1:1000* | Up to 1:1000* |

| Instruments | 80+ | 74 | 230+ |

| Stock Trading | No | No | Yes |

| Expert Advisors | No | Yes | Yes |

| Swap-Free Option | Yes | Yes | Yes |

*Maximum leverage depends on the regulatory entity that holds your account — for example, CySEC-regulated accounts follow ESMA rules (typically capped at 1:30 for retail clients), while other OctaFX entities may permit higher leverage up to 1:1000. Always confirm leverage for your specific account during signup.

Islamic (Swap-Free) Accounts

OctaFX also offers swap-free accounts that comply with Islamic finance principles. These accounts do not charge overnight swap fees on open positions, making them suitable for traders who require Shariah-compliant conditions. Check eligibility rules and any restrictions prior to opening a swap-free account.

Demo Accounts

Demo accounts are available for all platforms (OctaTrader, MT4, MT5) and let you practice trading with virtual funds. Demo accounts mirror live pricing and platform features, so use them to test strategies, compare platforms, and assess the trading experience before depositing real money.

Tradable Instruments

OctaFX provides a broad mix of tradable instruments, though availability differs by platform and account type:

Forex

OctaFX offers 50+ currency pairs across majors, minors, and exotics, including:

- Major pairs (EUR/USD, GBP/USD, USD/JPY)

- Minor pairs (EUR/GBP, AUD/CAD)

- Exotic pairs (USD/MXN, EUR/TRY)

Commodities

Trade common commodities as CFDs, such as:

- Metals — Gold, Silver

- Energies — Crude Oil (Brent/WTI), Natural Gas

Indices

Access major global indices including:

- US indices (Dow Jones 30)

- European indices (Germany 40, UK 100)

- Asian indices (Japan 225, China 50)

Stocks

Stock CFDs (and depending on account/region, real stocks) are available primarily on MT5. Examples include:

- US tech (Apple, Tesla, Amazon)

- Financials (JPMorgan, Wells Fargo)

- 200+ stock CFDs (varies by platform)

Cryptocurrencies

Crypto CFDs are offered on major coins, for example:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC), Ripple (XRP), and 20+ altcoins

Real Stocks

OctaFX also offers access to real stock ownership for accounts meeting higher funding thresholds (e.g., $10,000+). This option is aimed at long-term investors seeking actual ownership rather than CFDs — confirm availability and eligibility when opening your account.

In short: MT5 provides the widest instrument range (230+ instruments), while OctaTrader and MT4 offer fewer instruments but retain the core forex and CFD markets. If you need specific instruments — stocks, crypto, or real stock ownership — choose MT5 and verify the instrument list for your account.

OctaFX Fees and Commissions

Understanding the cost structure is vital when choosing a forex broker. Below is a clear breakdown of OctaFX’s trading and non-trading fees so you can estimate your expected trading costs and compare prices across platforms.

Trading Costs

| Instrument | Average Spread | Commission | Swap Fees |

| EUR/USD | 0.9 pips | $0 | Free (all accounts) |

| GBP/JPY | 2.4 pips | $0 | Free (all accounts) |

| Gold (XAU/USD) | 32 pips | $0 | Free (all accounts) |

| Crude Oil | 0.11 pips | $0 | Free (all accounts) |

| Apple (stock CFD) | 0.17 points | $0 | Free (all accounts) |

| Bitcoin (BTC/USD) | $26-28 | $0 | Free (all accounts) |

Non-Trading Fees

| Fee Type | Amount | Notes |

| Deposit Fee | $0 | OctaFX does not charge deposit fees; third-party processors may. |

| Withdrawal Fee | $0 | OctaFX typically charges $0; payment providers or banks may deduct fees. |

| Inactivity Fee | $0 | No fee for dormant accounts per OctaFX policy. |

| Account Maintenance Fee | $0 | No monthly or annual maintenance fees. |

All OctaFX accounts are advertised as swap-free by default, meaning positions held overnight do not incur standard swap/rollover charges. This can reduce holding costs for swing traders and long-term positions — confirm eligibility and any conditions that may apply to specific account types.

Overall, OctaFX’s fee model emphasizes zero commission and swap-free trading, which can make the broker cost-effective for many traders. However, spreads on some commodities and indices are wider than industry averages, so compare the total price (spread + any payment fees) for the instruments you trade most.

Deposits and Withdrawals

OctaFX supports a variety of payment methods for deposits and withdrawals. Processing times and availability can vary by region and payment provider.

Deposit Methods

- Credit/Debit Cards: Visa, Mastercard — typically instant

- E-wallets: Skrill, Neteller — usually instant

- Cryptocurrencies: Bitcoin, Ethereum, Litecoin — 3–30 minutes (network dependent)

- Bank Transfers: Time varies by country and bank

- Local Payment Methods: Availability depends on your region

Withdrawal Methods

- E-wallets: Skrill, Neteller — often processed in 1–3 hours

- Cryptocurrencies: Bitcoin, Ethereum, Litecoin — typically 1–3 hours

- Bank Transfers: Varies by country and bank — 1–5 business days common

- Credit/Debit Cards: Visa, Mastercard — usually 1–3 business days

The standard minimum deposit is $25, which lowers the barrier to entry for new traders. Withdrawal minimums differ by method — e-wallets often start at $5, while card withdrawals commonly require $20 or more. OctaFX does not normally charge deposit or withdrawal fees, but third-party processors or your bank may apply charges.

Some users report occasional withdrawal delays or rejections. To minimize issues: complete KYC verification in full, ensure your payment details match verified documents, and follow any local banking requirements. Typical KYC documents include a government ID and proof of address (utility bill or bank statement).

Ready to Start Trading with OctaFX?

Open an account today with a $25 minimum deposit and test the platforms via demo accounts to evaluate spreads, tools, and the deposit/withdrawal process before funding a live account.

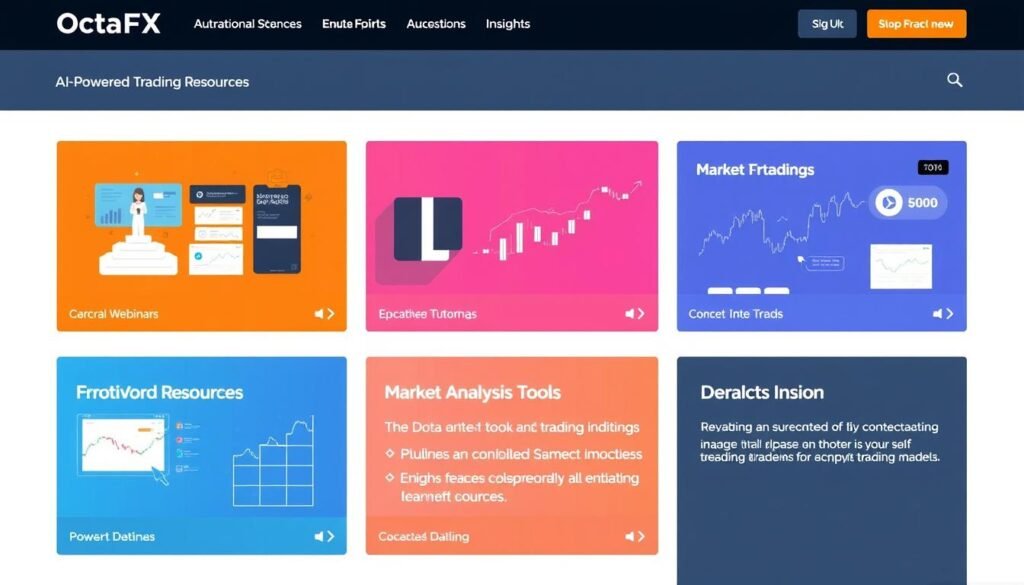

Research and Education

OctaFX provides a broad suite of research tools and educational content designed to help traders improve analysis skills and make informed trading decisions. Resources span real-time tools, structured courses, and bite-sized content for traders at every level.

Research Tools

- OctaVision: AI-powered performance analytics that highlight strengths, weaknesses, win/loss ratios, and risk metrics to help users refine their strategies.

- Economic Calendar: Tracks macro events and data releases that move markets so traders can plan entries and manage risk around news.

- Market Overviews: Short daily video rundowns and market commentary to keep traders up to date on market drivers.

- Trading Signals: Actionable trade ideas and setups that can be used as starting points for further analysis.

- News Screener: Filters recent market developments and headlines relevant to your instruments.

- Trading Session Tracker: Displays active market sessions and typical liquidity windows for different instruments.

Educational Resources

- Webinars: Regular live sessions covering basics, strategy, and platform walkthroughs, often in multiple languages.

- Video Tutorials: A large library of step-by-step videos that cover platform features, technical analysis, and strategy concepts.

- Trading Course: A structured multi-lesson program that walks beginners through core trading concepts and practical skills.

- Articles & Guides: Written content covering fundamentals, indicators, and risk management to support self-paced learning.

- Glossary: Clear definitions of common trading terms to help new users learn the language of markets.

- Demo Contests: Periodic practice competitions that let traders test strategies in a simulated environment.

The mix of tools and content makes OctaFX suitable for users who want a combination of technical analysis resources and guided learning. The platform content is localized in several languages to improve accessibility. If you rely heavily on technical research, prioritize testing OctaVision and the economic calendar on a demo account to see how the analytics integrate with your trading workflow.

Customer Support

Reliable support is essential for a smooth trading experience. OctaFX offers multiple support channels and localized service to assist users across regions.

- Live Chat: 24/7 multilingual chat (automated language routing before a human agent) for quick answers and technical help.

- Email Support: support@octafx.com — for account issues, documentation, and formal requests.

- Help Center: Detailed FAQ and step-by-step guides covering account setup, deposits, withdrawals, and platform use.

Support is available in multiple languages (improving accessibility for international traders), and live chat response times are generally fast for routine queries. Email replies may take longer for complex issues. For best results when contacting support, include your account ID, clear screenshots, and any transaction references to speed problem resolution.

User feedback often highlights helpful and responsive support for technical questions and onboarding — though experiences can vary by region and issue type. Always test support responsiveness during the demo/trial phase if prompt customer service is a priority for your trading activities.

OctaFX Pros and Cons

Based on our analysis and user feedback, below are the main advantages and disadvantages of trading with OctaFX — concise points to help you weigh the broker’s suitability for your trading style.

Pros

- Multiple trading platforms: Choice of OctaTrader, MT4, and MT5 covers beginners through advanced traders, letting you pick the platform that fits your tools and workflow.

- AI-powered analytics: OctaVision provides performance metrics and insights to help traders improve risk management and strategy.

- Swap-free trading: OctaFX offers swap-free accounts, which reduce overnight holding costs for swing traders and those seeking Shariah‑compliant options.

- Low entry barrier: $25 minimum deposit makes it accessible for new traders to open an account and test the platform.

- Strong educational content: Extensive tutorials, webinars, and guides in multiple languages support learning and platform onboarding.

Cons

- Regulatory limitations: While regulated in Cyprus and South Africa, OctaFX is not licensed in major markets such as the US or UK, which may concern traders prioritizing top-tier oversight.

- Two-factor authentication: Historically lacked 2FA — confirm current security offerings, as absence of widely used 2FA is a notable security drawback.

- Wider spreads on some instruments: Commodities and certain indices can have above-average spreads, which may be unsuitable for scalpers and fee-sensitive day traders.

User Experience

The overall trading experience on OctaFX is generally positive, with a few practical considerations depending on your priorities.

Platform Experience

OctaTrader provides a clean, intuitive interface for everyday trading tasks and account management. The MetaTrader platforms (MT4/MT5) deliver the robust analysis and automation features that experienced traders expect.

Mobile Experience

The OctaFX mobile app and MT4/MT5 mobile apps allow traders to manage open positions, receive real-time alerts, and perform basic analysis on the go. Mobile apps are convenient but lack some advanced desktop-only charting and backtesting capabilities.

Account Management

The account dashboard is straightforward: easy fund management, clear navigation between platforms, and a visible progress indicator during sign-up. This makes account setup and day‑to‑day management user-friendly for most users.

Localization

OctaFX localizes content, support, and payment options for many regions, improving accessibility for international traders. Multilingual support and local payment methods simplify onboarding in several markets.

Note: a subset of users report occasional withdrawal delays or rejections. If fast, frictionless access to funds is crucial, verify withdrawal procedures and test small withdrawals after account verification.

Who Is OctaFX Best For?

OctaFX tends to suit particular trader profiles better than others. Below is a quick guide to help you decide if the broker matches your needs.

Beginners

Why it fits:

- Low $25 minimum deposit reduces upfront cost to start trading.

- User-friendly OctaTrader platform and demo accounts speed learning.

- Comprehensive educational resources and OctaVision analytics support skill development.

Swing Traders

Why it fits:

- Swap-free accounts eliminate overnight swap fees, lowering holding costs.

- Competitive spreads on major forex pairs benefit multi-day positions.

- Research tools and economic calendar help manage event risk over several days.

Copy Traders

Why it fits:

- Dedicated copy trading options let users follow master traders.

- Performance rankings and risk scores help evaluate potential leaders to follow.

- No apparent extra fees for copy trading beyond normal trading costs.

Who might prefer alternatives: active scalpers and day traders seeking the absolute tightest spreads, or traders who require regulatory protection from the highest-tier regulators (e.g., US, UK) should compare other brokers before deciding.

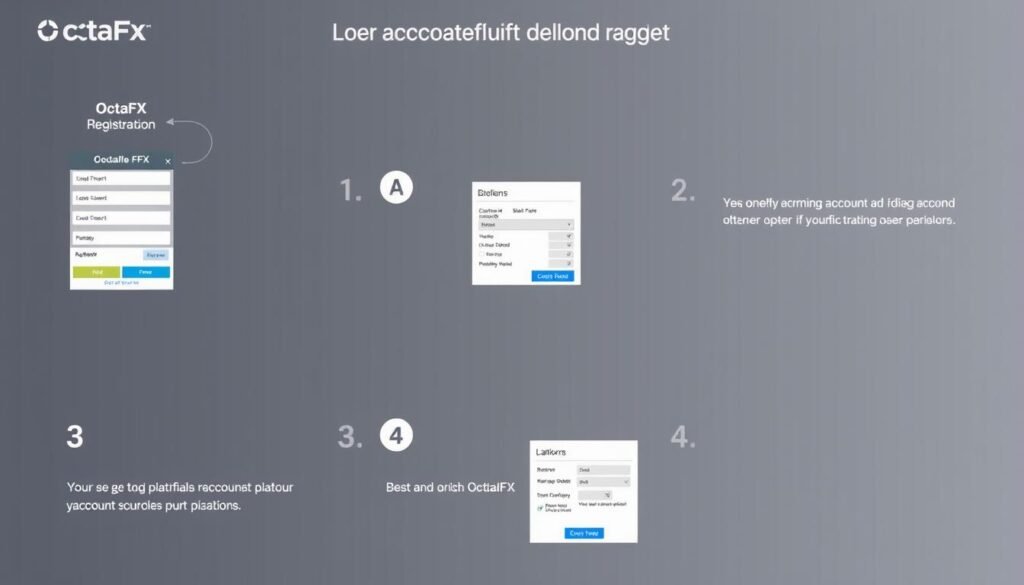

How to Get Started with OctaFX

Opening an account with OctaFX is straightforward. Below is a step-by-step process plus practical tips to speed verification and get you trading — or demo-testing — quickly.

- Registration: Go to the OctaFX website and click “Sign Up.” Enter your email and create a secure password.

- Personal Information: Provide your full name, address, and phone number as they appear on your identity documents.

- Economic Profile: Complete basic questions about employment, income source, and trading experience — this helps set appropriate risk limits and leverage.

- Verification (KYC): Upload required documents — a government ID or passport and a proof-of-address (utility bill or bank statement, usually dated within 3 months). Tip: submit clear, color scans or photos to avoid delays.

- Choose Account & Platform: Select your preferred platform (OctaTrader, MT4, or MT5) and choose account settings like base currency and leverage. Remember leverage options depend on the regulatory entity for your account.

- Deposit Funds: Make your initial deposit (minimum deposit commonly $25). Pick a payment method available in your region — cards, e-wallets, crypto, or bank transfer — and note processing times and any third-party fees.

- Start Trading or Demo-Test: Download the chosen platform or use the web version. If you prefer to practice, open a demo account to test strategies and the trading experience with virtual funds.

Timing: registration itself typically takes only a few minutes; KYC verification times vary by region and document quality — often completed within 24–48 hours when documents are clear. Processing times for deposits and withdrawals depend on the payment method.

Quick checklist to avoid delays: 1) Use high-quality scans/photos of ID and proof of address; 2) Ensure names and addresses match exactly; 3) Provide requested economic profile answers honestly; 4) Start with a small deposit to verify payment method before scaling up.

Experience OctaFX's Trading Conditions

Try a demo account first or open a live account from $25 to test the trading platforms, spreads, and deposit/withdrawal flow with minimal upfront cost.

OctaFX Review: Final Verdict

OctaFX delivers a solid, feature-rich trading experience for many retail traders. The broker offers multiple platforms (OctaTrader, MT4, MT5), AI-powered analytics via OctaVision, and extensive educational content — all combined with a low minimum deposit that makes it easy for new users to get started. These strengths make OctaFX particularly attractive to beginners, swing traders, and those interested in copy trading.

On the downside, OctaFX’s regulatory footprint is more limited compared with brokers licensed in top-tier jurisdictions such as the US or UK, and the broker has historically lacked two-factor authentication (confirm current security options before funding an account). Additionally, spreads on certain commodities and indices can be wider than industry leaders — a factor to consider if you’re a scalper or a high-frequency day trader.

Bottom line: OctaFX is a competitive broker that offers good value for traders who prioritize platform variety, robust educational content, and low-cost entry. It also offers attractive options for copy trading and swing trading thanks to its swap-free accounts and research tools. If your priorities are the highest-tier regulatory protection or the absolute tightest spreads for scalping, compare OctaFX with alternatives regulated in markets like the UK or US before deciding.

We recommend starting with a demo account to test the platforms, confirm live spreads and deposit/withdrawal flows, and verify which regulated entity your account will be held with before committing real funds.

Frequently Asked Questions

Is OctaFX regulated?

Yes. OctaFX operates through several entities: OCTA Markets Cyprus Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 372/18, and Orinoco Capital (Pty) Ltd is regulated by South Africa’s Financial Sector Conduct Authority (FSCA) under license number 51913. Protection and rules depend on the entity holding your account, with the CySEC entity offering EU-style safeguards such as participation in the Investor Compensation Fund.

Does OctaFX offer a demo account?

Yes. OctaFX provides free demo accounts for OctaTrader, MetaTrader 4, and MetaTrader 5. Demo accounts use virtual funds, mirror live pricing, and are useful for testing platforms, strategies, and the overall trading experience before opening a live account.

What is the minimum deposit for OctaFX?

The minimum deposit is commonly , which makes the broker accessible to many new traders. Minimums can vary by payment method and region, so check the deposit requirements for your country and chosen payment option when opening an account.

How long do withdrawals take with OctaFX?

Withdrawal times depend on the method: e-wallets and cryptocurrency withdrawals are often processed within a few hours (1–3 hours), while bank transfers and card refunds can take 1–5 business days. OctaFX typically does not charge withdrawal fees, but third‑party processors or banks may apply their own charges.

What leverage does OctaFX offer?

Leverage varies by regulatory entity and instrument. For example, the CySEC-regulated entity follows ESMA limits (typically up to 1:30 for retail forex), while other OctaFX entities may offer higher leverage (up to 1:1000). Leverage also differs across markets — forex pairs usually have the highest available leverage compared with stocks or crypto.

Does OctaFX offer copy trading?

Yes. OctaFX offers copy trading through its dedicated copy trading solution, allowing users to follow and replicate trades of experienced “Master Traders.” The copy trading service typically includes performance rankings and risk scores to help you evaluate leaders; there are no extra platform fees beyond standard trading costs, but always review the specific terms before joining.